Will collect more if its down again. I think SP Setia is the only giant property developer currently sitting on net cash, good landbank (local and o/sea) and mix combination of mid and high end residential and commercial development.

Maintain buy at RM3.19 with fair value of RM5.41: We reaffirm our “buy” rating on S P Setia with our fair value unchanged at RM5.41, at par to its fully-diluted NAV estimate.

===============================================================

S P Setia Bhd

(Sept 23, RM3.08)

Maintain buy at RM3.19 with fair value of RM5.41: We reaffirm our “buy” rating on S P Setia with our fair value unchanged at RM5.41, at par to its fully-diluted NAV estimate.

S P Setia reported 3QFY11 earnings of RM91 million, taking its 9MFY11 net profit to RM246 million, or a robust growth of 39% year-on-year. This is well within our estimate, covering 78% of our full-year earnings projection of RM311 million although it came way above consensus estimates by 12%.

At a glance, earnings were flat quarter-on-quarter. However, stripping off the RM32 million gain from the sale of Tenby International School in Setia Alam, core earnings jumped by half. Earnings were driven by progress billings at Setia Alam, Setia Eco Park, Bukit Indah and Setia Walk.

S P Setia’s sales remain strong, recording RM2.3 billion in new sales as at end-August, already surpassing its best ever full fiscal year sale. We expect the group to record sales above its bullish target of RM3 billion and FY11F earnings may exceed our current earnings forecast of RM311 million.

While latest monthly sales have dropped i.e. August figures dropped by some 12% month-on-month to RM186 million due to slower launches, sales are expected to rebound sharply in the next two months. S P Setia is expected to recognise the sale of the boutique offices in KL Eco City as the privatisation agreement with DBKL would be finalised soon. Sales from its maiden launch in Australia would also likely be accounted next month.

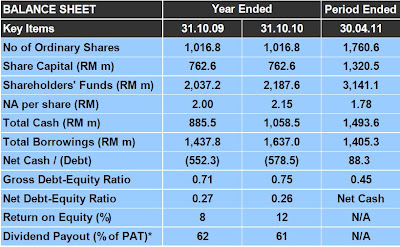

While there are a lot of uncertainties given the confidence crisis in the global economy, sector fundamentals remain solid. And S P Setia’s earnings are very much secured by record unbilled sales of RM3.9 billion (about two times its FY10 revenue). Should the economy turn, we believe sales would remain resilient and it has products to cater to the mass market; for example, Setia Alam and the recent land acquisition in Semenyih would provide more opportunities to launch mid-segment houses.

Following the weak sentiment, the stock has dropped by some 31% since its high of RM4.62. S P Setia is currently trading at a steep discount of 41% and an undemanding forward FY12F-FY13F PE of 11 to 14 times. We believe it is a good opportunity to accumulate the stock, notwithstanding the current weak market sentiment. — AmResearch, Sept 23

No comments:

Post a Comment